Monthly Report (January, 2021)

January (2021), first month of the first Quarter 2021

Dear Copier and Followers,

a new very interesting year is beginning with probably a higher degree of volatility than the average of the last years.

Our strategy is studied to take advantage of that through very volatile instruments such as TQQQ, GDXJ and one of the most volatile among the defensive assets TLT.

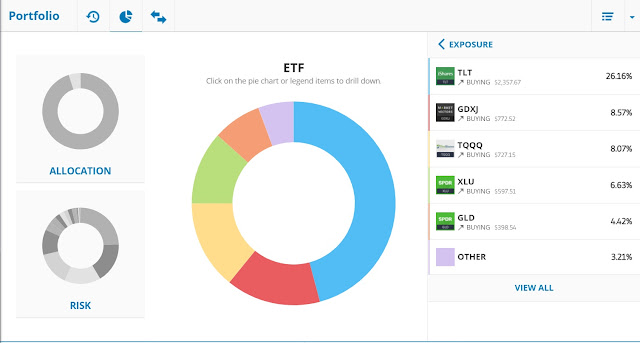

Figure 1 shows how we were positioned by end of January.

January was a consolidation month for Gold and TLT, while stocks kept rising at a moderate pace, the month ended with a -1,32% but our strategic positioning is preparing for a pool back of the market that should give us a good chance to increase again our stocks positions and gain during the rest of the Quarter.

Figure 1: Portfolio structure

The ETFs remain the largest component of the PortFolio, on Figure 2, you can analyze the major components of it.

|

| Figure 2: ETF structure |

The major component is TLT, which has been consolidating for the best part of the last six months.

We will gradually increase the holding of the long term American Treasuries because I believe they offer some of the best protections again market corrections.

Another major ETF we hold is GDXJ, one of the most volatile Gold miner ETF.

This asset will help to protect the portfolio moving forward against the possible inflation that the stimulus packages should generate IF approved from the Parliament.

The gold has been consolidating, together with TLT and that's typical because as TLT falls due to higher expectations for future economic growth (as well as increased public debt), is attracting a larger volume of investors which sell part of their gold holding searching for higher yields.

TQQQ instead will expose us to the market growth that most likely will continue on the NASDAQ assets but with a much greater volatility which is welcomed from our daily trading style of action.

Since the market feels a bit "toppy", we might also increase further protective assets such as XLU that have been left behind recently and offer some reduction of investment risks during slowing market growth periods.

|

| Figure 3: Stocks structure |

After the recent run, it is becoming quit difficult to find stocks with high upside short term potential, so, for this semester we will focus our strategy toward BA which i believe is underestimated and will benefit from the Covid recovery, airlines such as DAL, and BABA (hit by the Chinese government tensions) and the banks which in my opinion offer a good value proposition.

We will also focus small investments in highest shortened stocks that have high probability to undergo "short squeezes".

I thank my Copiers and Followers for the confidence and I wish you a great time moving forward.

Daniele

~~~~~~~~~~~~~~

The

graphs and prices shown in this analysis were taken using as a source

www.etoro.com, the platform I am using for my trading as DanieleTrader.

Whoever

is interested to follow my trading activity there is welcome to

subscribe to the platform using the following link and follow me or

Copy-Trade my activity:

Link to Subscribe to eToro Platform

Disclaimer

The content published in this blog represents my personal view.

It

is intended for information and educational purposes only and should

not be considered investment advice or an investment recommendation.The reader is solely responsible for his/her investment choices

Comments

Post a Comment